How much pension will you receive under weak or strong economic circumstances?

We cannot predict economic development and investments’ results. However, we can make an estimate of the pension that you will most likely receive. Also of the pension that you can expect to receive under strong or weak economic circumstances.

The government wants you to gain a better insight into your pension. For this reason we will make this estimate a few times per year. View it carefully. You can see how your pension develops over time.

Check your current pension details

View your pension amounts at least once per year at My pension (this pension fund) en mijnpensioenoverzicht.nl (government). You will remain informed of any changes and can take individual measures, if necessary.

Want to know more about your pension plan?

You will find information and answers to your question on this website, i.e. at Pensioen 1-2-3. You can submit your questions at contact. We are happy to assist you.

Read more:

You can find the estimate on your Uniform Pension Statement (UPO) and at mijnpensioenoverzicht.nl:

- On your UPO you can read how much pension you are expected to receive from our pension fund. In the section ‘What happens if economic circumstances are weak or strong for a longer period of time?’ you can find an estimate of the pension that you are expected to receive under weak or strong economic circumstances.

- At mijnpensioenoverzicht.nl you can find your total pension and your state retirement pension (AOW). Here you can find the estimate under 'Vooruitblik' (‘preview’). We have applied the government rules when calculating the amounts. Also, we have calculated the amounts in the same way for all participants. The various economic situations only show an estimate of your retirement pension.

If you compare the amounts on your Uniform Pension Statement (UPO) with those at mijnpensioenoverzicht.nl, you will see that they are not the same.

What do you see in the picture on your UPO?

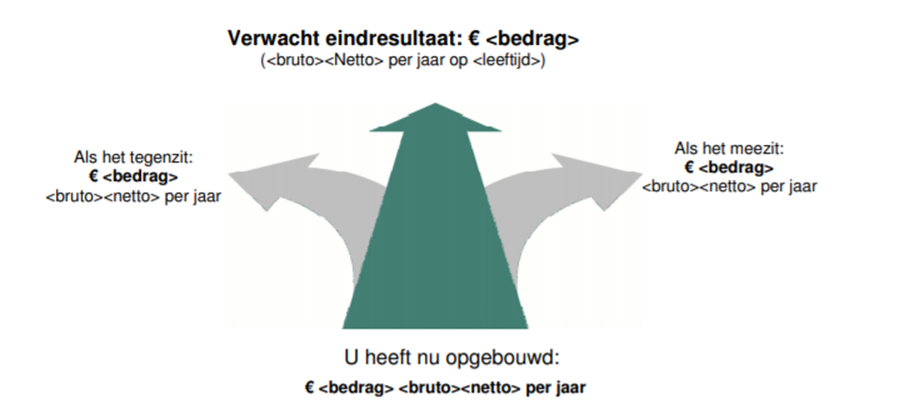

Do you accrue pension with us or are you occupationally disabled with a waiver of premium? Or do you no longer accrue pension with our pension plan but do you still have pension with us? If so, you will see the following picture on your UPO under ‘What happens if economic circumstances are weak or strong for a longer period of time?’:

The picture gives you an estimate of the pension that you will receive from our fund. The 4 amounts show the pension that you will receive as of 68 years, the standard retirement age at our pension fund. You also see the expected gross pension per year.

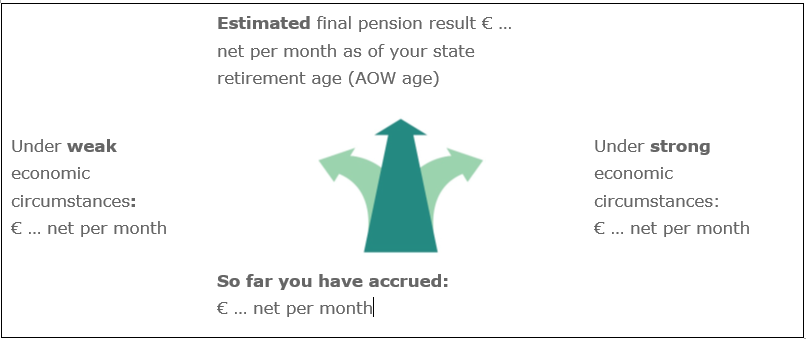

What do you see in the picture at mijnpensioenoverzicht.nl?

Under ‘Vooruitblik'('outlook’) at mijnpensioenoverzicht.nl you will find the following picture which is nearly identical. However, there are some important differences with the picture on your UPO:

The 4 amounts at mijnpensioenoverzicht.nl show your state retirement pension (AOW) and your total pension with all the pension administrators (pension funds and insurance companies) where you have accrued pension. You see the pension as of your state retirement age. Also you see the expected net pension per month.

Find out what the amounts signify below.

At the bottom of the picture you see the pension that you have accrued so far

You have already accrued a part of your future pension. This is the amount under the arrows.

We have calculated your ‘estimated final result’ in 3 situations

Above and on either side of the arrows you see an estimate of your pension in 3 situations:

- In the middle at ‘expected final result’ you see the pension that you appear to achieve at this moment. There is a chance that your pension will be higher or lower.

- On the left you see the pension that you may expect to achieve if future economic circumstances are strong.

- On the right you see the pension that you may expect to receive if future economic circumstances are weak.

Are you still accruing pension with us?

The estimates of the amounts are based on the assumption that you will continue to accrue pension in our pension plan. For the UPO, this is until the age of 68 years, the standard retirement age at our fund. For mijnpensioenoverzicht.nl this is until your state retirement age. If you stop working earlier, your pension will be less than the amounts that you see in these pictures.

We don’t know how the economy will develop in the future. The interest rate may rise or fall. Investments can have high or low results. This will influence the level of your pension. Prices may also increase or decrease and as a result you can buy more or less with your pension. All these factors have been included when calculating your expected pension.

Economists have therefore come up with 2.000 different situations for our future. In which the interest rate is high or low and investments have good or bad results. And prices increase or decrease. However, as reality can be different from the 2,000 situations, you will only know exactly how high your pension will be when you retire. The risk of financial windfalls or setbacks lies with you.

We have not included any changes in your personal or work situation. These may also have consequences for your pension. Such as a higher or lower salary or a divorce. Refer to Pensioen 1-2-3 for more information.

The value of your future pension depends, among others, on the prices of products and services in the Netherlands. If prices increase and your pension does not, or if your pension does not increase in line with prices, the value of your future pension will drop as you can buy less for the same amount. Alternatively, jf prices remain the same (or decrease), or if your pension increases quicker than prices, your future pension may be worth more. And you can buy more for the same amount.

An example

The current price of a bread is € 3.-. You receive a pension of € 75.-. Over 5 years, due to price increases, the price of bread has increased by 10% and will cost you € 3.30.

- If your pension remains the same, or does not increase in line with prices, you can buy less bread. The value of your pension will drop.

- If your pension also increases by 10% (to € 82,50), you will still be able to buy the same amount of bread. Your purchase power remains the same and your pension keeps its value.

We have processed the price changes in your expected pension

We have already taken into account any increases or decreases in prices when estimating your expected pension. We have made estimates of your future pension in 3 different economic situations. These are the amounts shown under the upper 3 arrows in the pictures on your Pension Overview of this pension fund (UPO) and at mijnpensioenoverzicht.nl. To show you what it means for your purchasing power we have converted these amounts into the present value of the euro.

You can use the amount in the middle above the arrows to see if your expected pension is high enough to make ends meet. Compare this amount for example with your current salary.

The other 2 amounts tell you more about the direction into which your pension may develop if economic circumstances are weak or strong. For example, if economic circumstances are weak for a longer period of time , the expected pension (the amount in the middle) will gradually become lower. Your expected pension will also not go up to the higher amount if economic circumstances are stronger for a couple of years. If we make new calculations in the future the amounts may also become higher or lower.

It is therefore advisable to check your pension regularly (i.e. once a year) to see in which direction it develops.

Have you already retired and do you receive state retirement pension (AOW)? If so, you can find a calculation of your expected pension over 10 years at mijnpensioenoverzicht.nl. You will see the gross amount that you appear to achieve in the following 3 situations:

- The pension that you appear to achieve over 10 years at his moment.

- The pension that you will achieve if economic circumstances are weak during the next 10 years.

- The pension that you will achieve if economic circumstances are strong during the next 10 years.

Your Uniform Pension Statement doesn’t contain a calculation of your pension over 10 years.

As of now amounts in a contribution agreement are calculated differently.

Are you participating in a contribution agreement?

You can check this on the 1st page of the Uniform Pension Statement (UPO). If you are, you can see an estimate of the pension capital that you are expected to achieve on your UPO under the section ‘What pension amount can you expect to accrue?’. Also of the retirement pension that you are expected to purchase with this capital at 68 years. As from 2020 we calculate this estimate in a different way and also base it on the 2000 different situations.